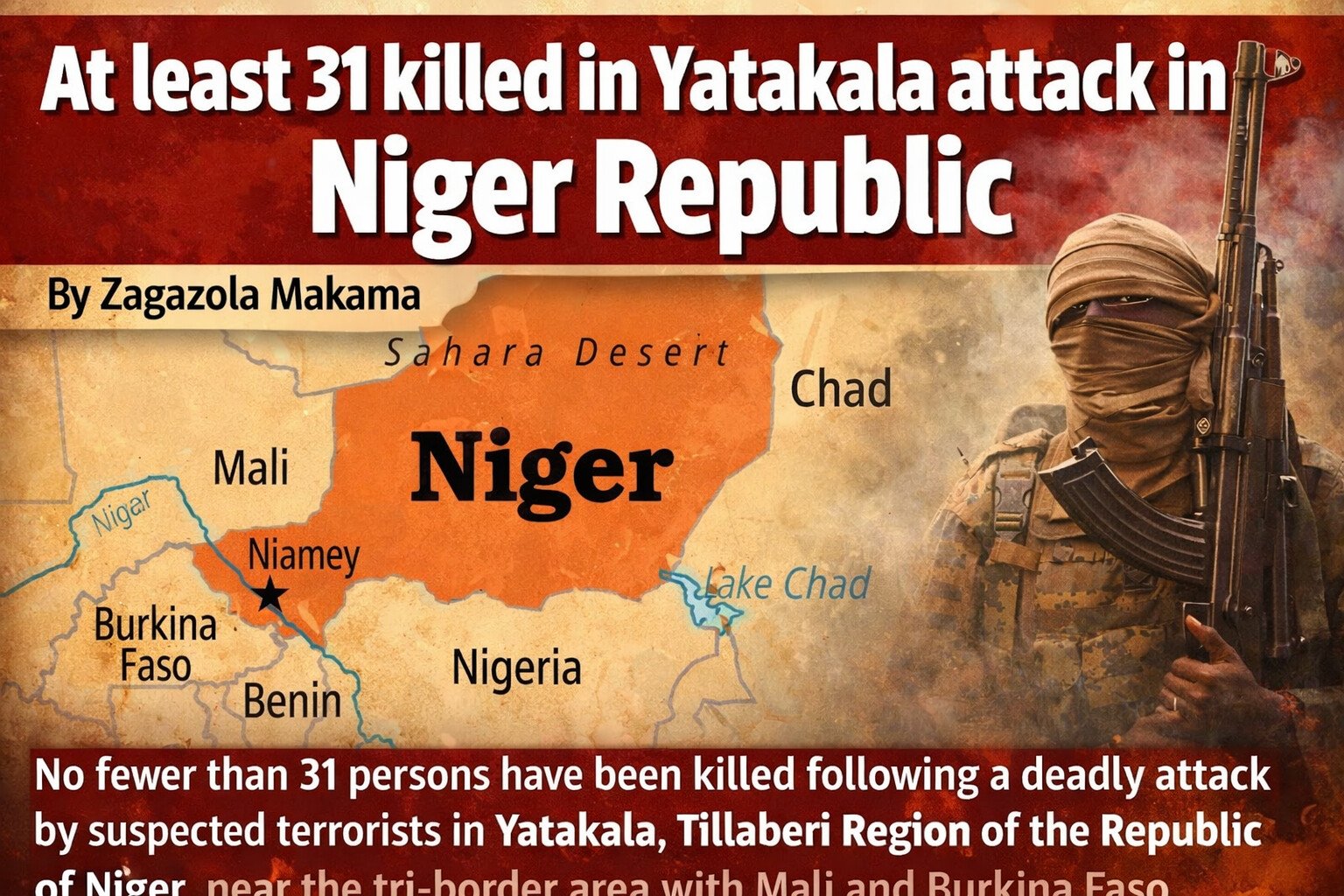

Niger’s Economic Crisis Deepens as Investors Withdraw Amid Instability

Niger is facing mounting economic challenges as investors increasingly pull out of the country, signaling a deepening financial crisis. The latest evidence of this came when the government failed to secure a much-needed FCFA 20 billion loan from the West African Monetary Union (UEMOA) financial market.

According to Financial Afrik, Niger’s latest issuance of Treasury Bonds (BAT) with maturities of 182 and 266 days attracted only FCFA 10.125 billion—just over half of the targeted amount, with a subscription rate of 50.63%. Even more concerning, investors completely snubbed the country’s three-year bonds, reflecting a complete lack of confidence in Niger’s long-term economic stability.

Investor Confidence at an All-Time Low

The reluctance of investors to engage with Niger’s long-term debt is primarily attributed to growing economic uncertainty, regional instability, and strained diplomatic relations with Benin. The closure of trade routes between Niger and Benin—an essential corridor for the landlocked country’s commerce—has further exacerbated financial woes. Niger’s banking sector is also facing a crisis, with liquidity shortages and rising debt burdens discouraging investment.

Beyond regional tensions, Niger is also struggling with its international financial commitments. A year ago, the government secured high-interest financing (above 7% annually) from China’s National Petroleum Corporation (CNPC), using its oil production as collateral. However, Niger has failed to meet its repayment obligations, putting it at odds with its Chinese partners and raising doubts over the future of its oil exports.

Similarly, the country’s uranium sector—once a key source of revenue—is also in turmoil. Ongoing disputes with French multinational ORANO and Canadian mining company Goviex have disrupted operations, further straining the nation’s economy.

Short-Term Survival, Long-Term Uncertainty

The consequences of Niger’s financial struggles are dire. President Abdourahamane Tiani’s government is increasingly reliant on short-term borrowing at high interest rates, making long-term economic planning nearly impossible. Without access to sustainable financing, the country remains trapped in a cycle of debt, economic instability, and growing investor distrust.

For Niger, the challenge now is not just economic recovery, but survival. Unless the government can restore investor confidence, resolve its trade and diplomatic tensions, and stabilize key sectors like oil and uranium, the nation risks plunging further into economic chaos.

As the crisis unfolds, experts warn that Niger’s financial woes could deepen if immediate steps are not taken to rebuild trust with investors and international partners. Restoring relations with Benin, addressing its debt obligations, and stabilizing domestic industries will be critical in preventing a full-scale economic collapse.

For now, however, Niger’s economic future remains uncertain, with short-term fixes offering little hope for long-term stability.